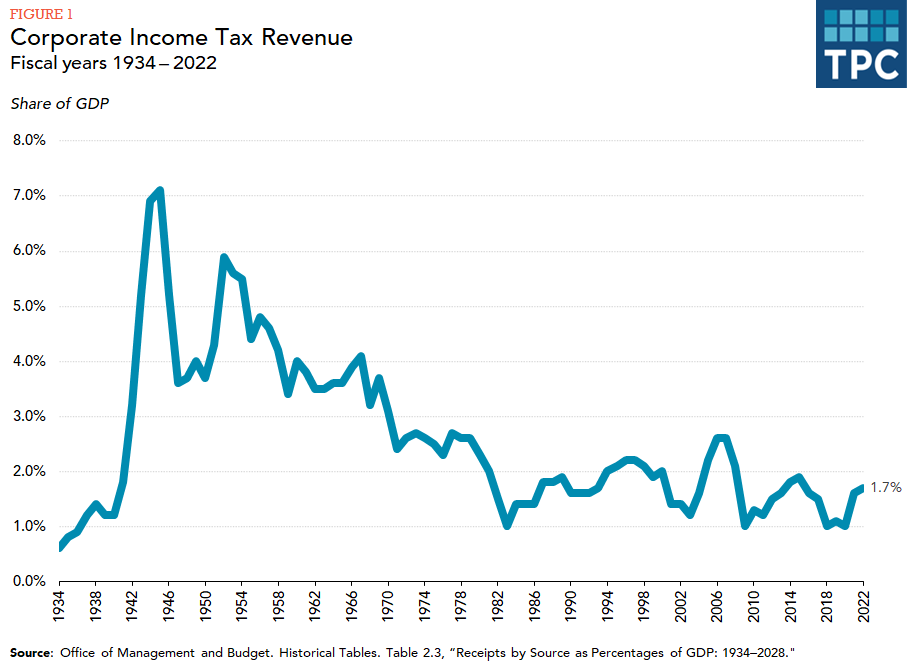

The Tax Cuts and Jobs Act (TCJA) reduced the top corporate income tax rate from 35 percent to 21 percent and eliminated the graduated corporate rate schedule and the corporate alternative minimum tax. The TCJA permitted full expensing of most new investments through 2022. The benefit will decrease by 20 percent annually until it is entirely phased out by 2027.

The benefit will be reduced by 20% each year until it ends in 2027.

This may seem self-evident. However, it is crucial to emphasize this point. To maximize tax season benefits as a small business owner, track your expenses diligently. Why? The IRS permits deductions for business expenses. See below.

The trip must take you away from your tax home (city/area where the business is located). The trip should require you to travel away from home for longer than a business day and require rest or sleep to meet work demands. If you rent a car to visit a customer for a day and incur expenses such as refueling or stopping for a meal, these costs may be deductible. The IRS website offers a detailed overview of what qualifies as deductible work-related travel expenses.

Home-based business owners or freelancers can deduct $5 per square foot for up to 300 square feet of homes used for business. That area must be solely for work. Therefore, utilizing your dining table as a workspace does not qualify for a tax deduction, irrespective of your intentions. Office supplies such as stationery, computers, printers, software, postage, and shipping expenses may be deductible if used for business purposes within the year of purchase. This point is crucial. Effectively managing tax season for a small business owner depends on accurate expense tracking. Why? Because the IRS allows for business expense-related deductions.

Startup Costs New entrepreneurs can deduct up to $5,000 in startup expenses for the latest tax year. This amount may encompass costs related to any training or travel undertaken, as well as expenses incurred for marketing your startup. Business Meals You can deduct up to 50 percent of your qualified food and drink expenses. What does qualified mean? The meal was related to business. Jot the following in an expense log: • The date and location of the meal • The business relationship of the person or people you dined with • The total cost of the meal

Eligible travel expenses for write-off purposes include airfare, accommodation costs, rental car charges, dry cleaning services, toll fees, and gratuities. However, any work-related travel expenses must meet the following requirements: The trip must be necessary for business.

The trip must take you away from your tax home (city/area where the business is located).

The trip should require you to travel away from home for longer than a business day and require rest or sleep to meet work demands. Renting a car to visit a customer, with refueling or meal stops, might be deductible.

The IRS website offers a detailed overview of what qualifies as deductible work-related travel expenses.

Under the simplified home office expenses, individuals operating a home-based business or working as freelancers can deduct $5 per square foot of their home that is used for business purposes, with a maximum deduction limit of 300 square feet. That area must be solely for work activities. A dining table workspace does not qualify for write-offs. Office supplies, including stationery, computers, printers, work-related software, postage, and shipping, are deductible if used for business purposes within the year of purchase.

We help clients collect the necessary supporting documents needed to accompany immigration forms. This can include records such as birth certificates, tax returns, and other essential documents required by USCIS. Thorough document collection is essential as it ensures that all necessary information is provided thereby significantly enhancing the likelihood of a successful application. Immigration from specialists is in high demand. We make sure that you will not miss any documents, and we look forward to helping you.

Moving to a new country can be overwhelming, especially with the complicated immigration laws that constantly change. One challenge for immigrants is managing the paperwork. These forms often ask for detailed information about a person’s background, work history, and even family details. Forms are often written in complex legal terms, making them hard to understand, especially for non-fluent speakers.

Mistakes in filling out these forms can cause delays, extra costs, or even lead to a denial of immigration benefits. We are Immigration Forms Specialists (IFSs), offering essential services for individuals seeking legal immigration assistance. We assist clients in accurately completing and submitting immigration forms. The need for skilled immigration forms specialists grows as laws change and new groups qualify for immigration benefits.

The need for skilled immigration forms specialists grows as laws change and diverse groups, qualify for various immigration benefits.

If you commenced your entrepreneurial venture in the most recent tax year, you may deduct up to $5,000 in startup expenses. This amount can include costs for training, travel, and marketing your startup.

You can deduct up to 50 percent of your qualified food and drink expenses. What does qualified mean? The meal was related to business. Jot the following in an expense log:

The date and location of the meal

The business relationship of the person or people you dined with

The total cost of the meal

Travel Expenses

Nakoff Tax & Accounting Service USA, LLC. — Expert tax planning and financial solutions nationwide.

Nakofftaxservice@gmail.com

719 Hudson street Winston Salem NC 27105 United States

Copyright © 2024 NAKOFF TAX & ACCOUNTING